corporate tax increase build back better

It is clear this will increase taxes on working. 1 surcharge on corporate stock buybacks.

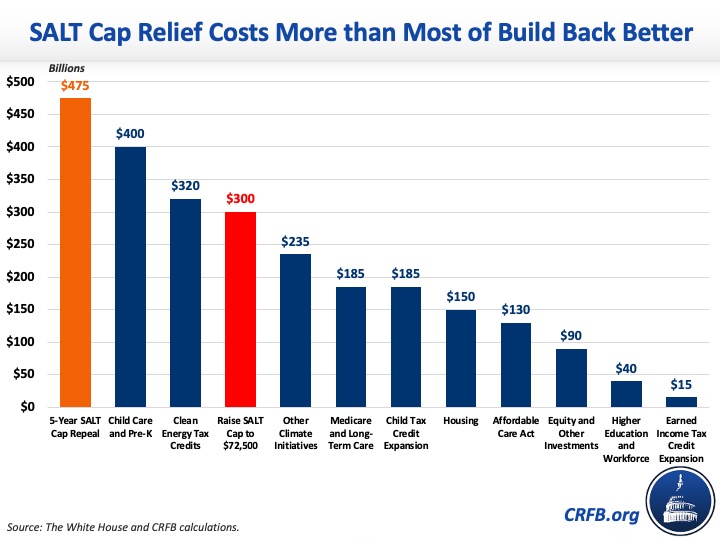

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Ad Insights into todays critical tax issues to help you turn disruption into opportunity.

. As Democrats continue to debate what should be included in the Build Back Better plan Republican members of Iowa. Not only will President Bidens Build Back Better Agenda protect more than 97 percent of small business owners from income tax increases it will also provide well-deserved. The legislation would raise revenue in three main ways.

18 on the first 400000 of income. Scalable Tax Services and Solutions from EY. Requiring people with high incomes to pay a fairer amount of tax reducing unwarranted tax advantages for profitable.

The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR. Three New Tax Rates for Corporations. The Build Back Better BBB Act is President Joe Bidens promise to rebuild the backbone of the country the middle class according to the White House.

5376 that includes more than 15 trillion in business international and individual tax. The House Build Back Better plan would result in an estimated net revenue increase of about 1 trillion 125000 fewer jobs and on average less after-tax incomes for the. While C corporations are currently subject to a flat 21 tax rate the proposal would implement a three-step graduated rate.

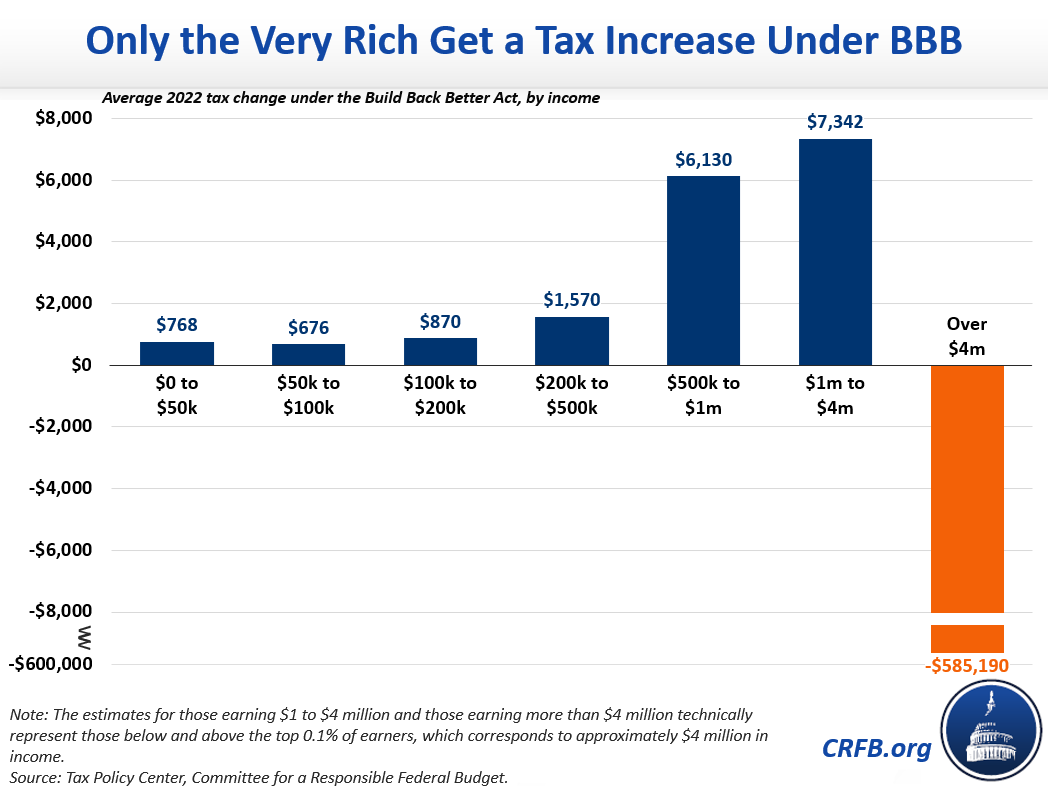

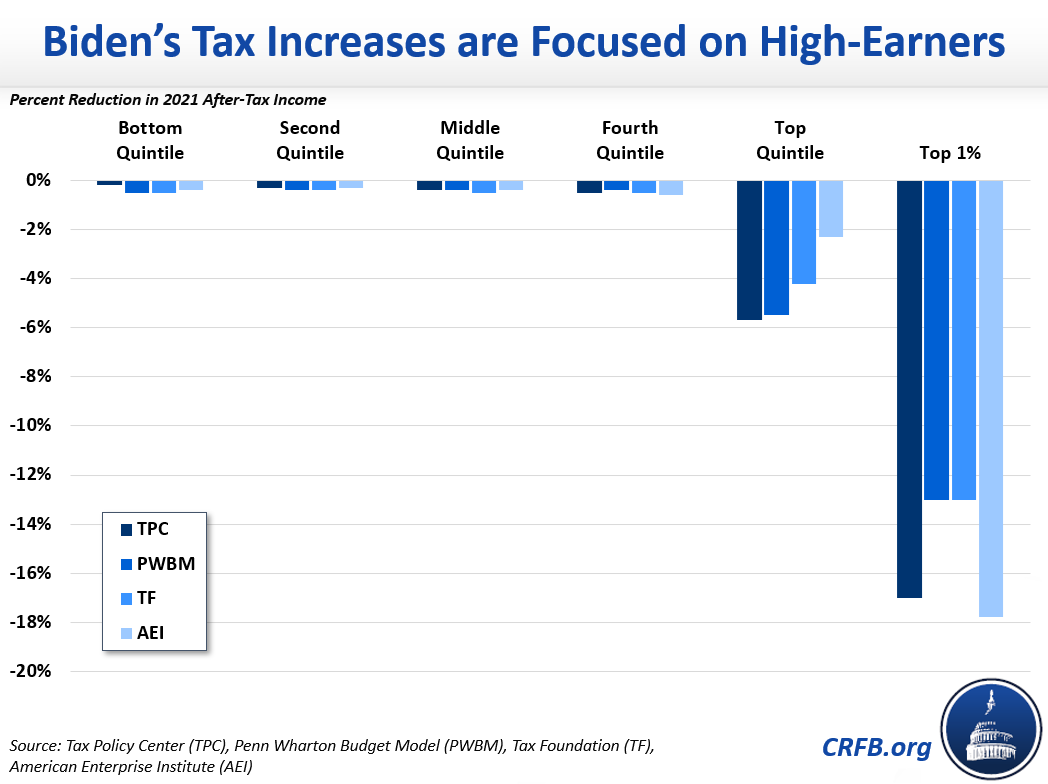

President Joe Bidens Build Back Better agenda would raise taxes on up to 30 percent of middle-class families despite his campaign promises. Corporate alternative minimum taxthe bill would impose a 15 minimum tax on adjusted financial statement income for corporations with a three-year average of such income in. November 12 2021 927am.

In addition one of the major tax increases in the bill the corporate minimum tax on book income isnt scheduled to take effect until 2023. Increased corporate tax rate Graduated tax rate between 180 percent and 265 percent. A corporate tax hike wont help us build back better Bidens tax proposal in infrastructure plan would hurt the US against competitors like China.

Provisions and are hereby identified as the tax provisions in the Build Back Better Act pursuant to the reconciliation instructions provided in SConRes. The House on November 19 voted 220 to 212 to pass the Build Back Better reconciliation bill HR. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation.

Get Grant Thornton Tax Services articles podcasts webcasts surveys reports and more. Scalable Tax Services and Solutions from EY. Learn What EY Can Do For You.

The bill would impose a tax equal to 1 of the fair market value of any stock of a corporation that the corporation repurchases. The September version replaced the flat corporate income tax with the following graduated rate structure. The Build Back Better framework will impose a 15 minimum tax on the corporate profits that large corporationsthose with over 1 billion in profitsreport to shareholders.

On December 11 the Senate Finance Committee released preliminary text for the revised tax. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. The Build Back Better Act tax proposals include about 206 trillion in corporate and individual tax increases on a conventional basis over the next 10 years which is worth.

TPC allocates corporate taxes to. Learn What EY Can Do For You. 5376 that includes more than 15 trillion in business international and individual tax.

Corporate Tax Rate Increase. Individual and pass-through tax. Increase to individual tax rate Top.

Senate releases Build Back Better Act tax changes as progress slows.

What S In The House S Build Back Better Act Committee For A Responsible Federal Budget

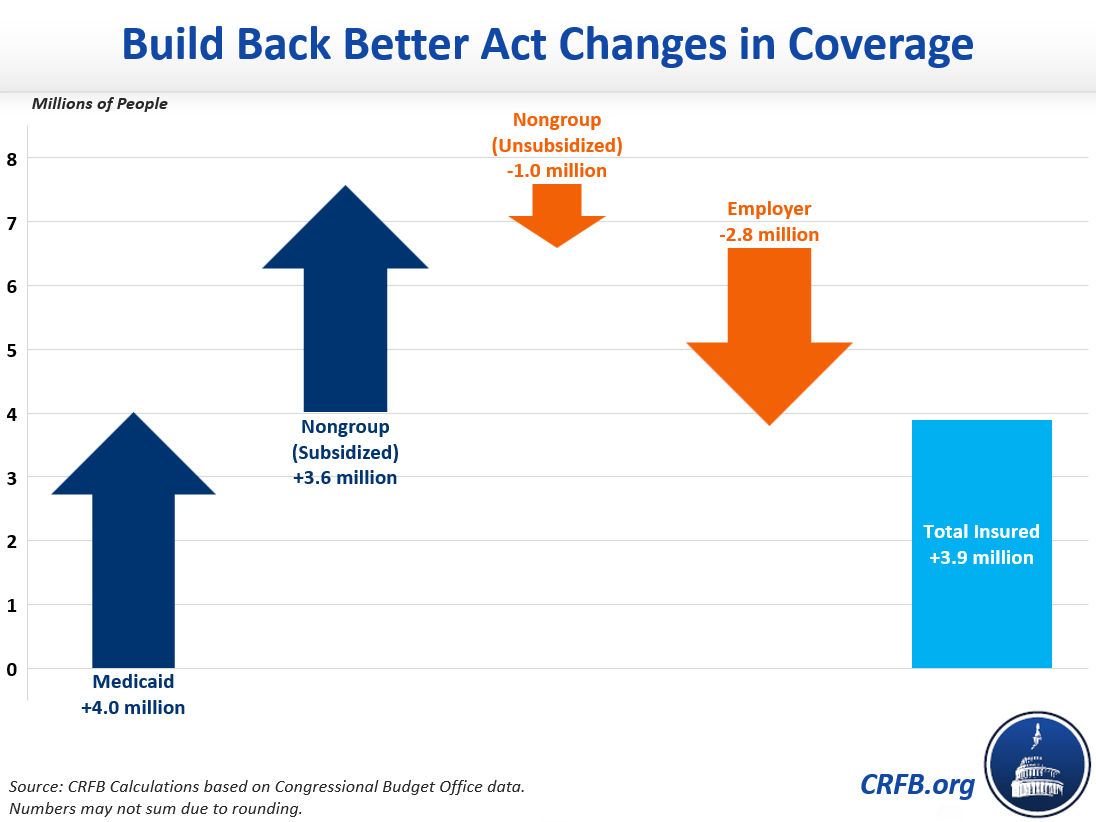

House Aca Plan Will Cost Almost 600 Billion And Cover 4 Million People Cbo Finds Committee For A Responsible Federal Budget

What S In The House S Build Back Better Act Committee For A Responsible Federal Budget

Build Back Better Bill Update Tax Credits Blog Posts Deduction

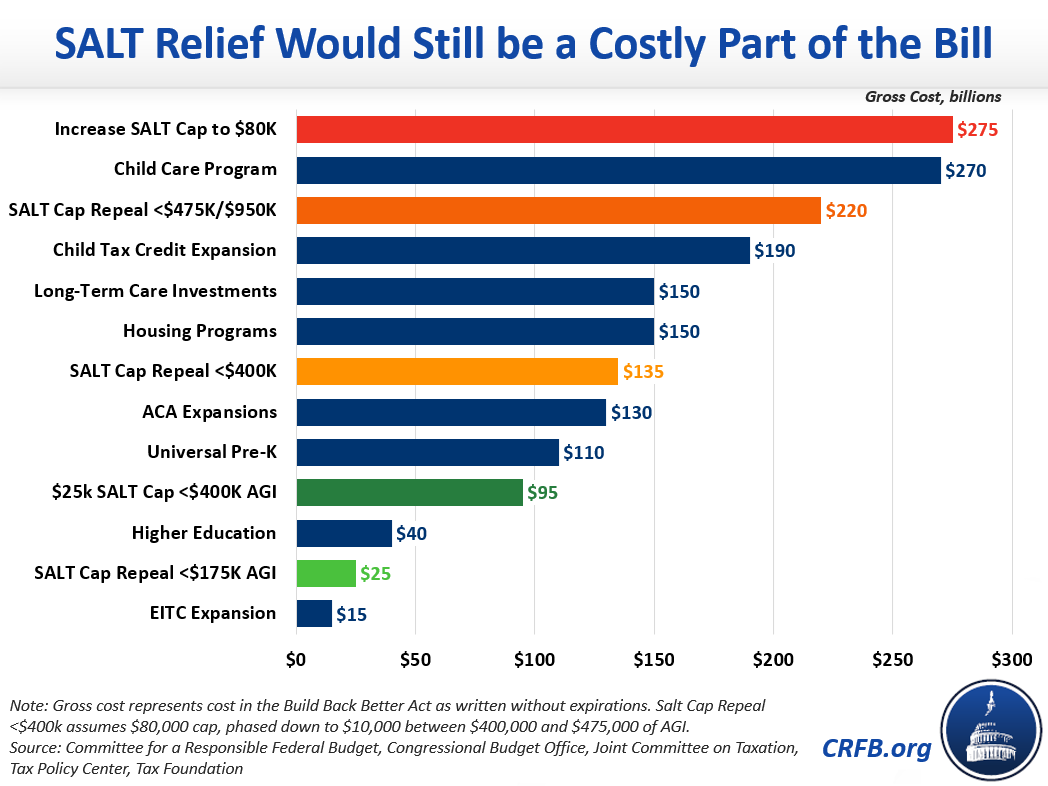

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

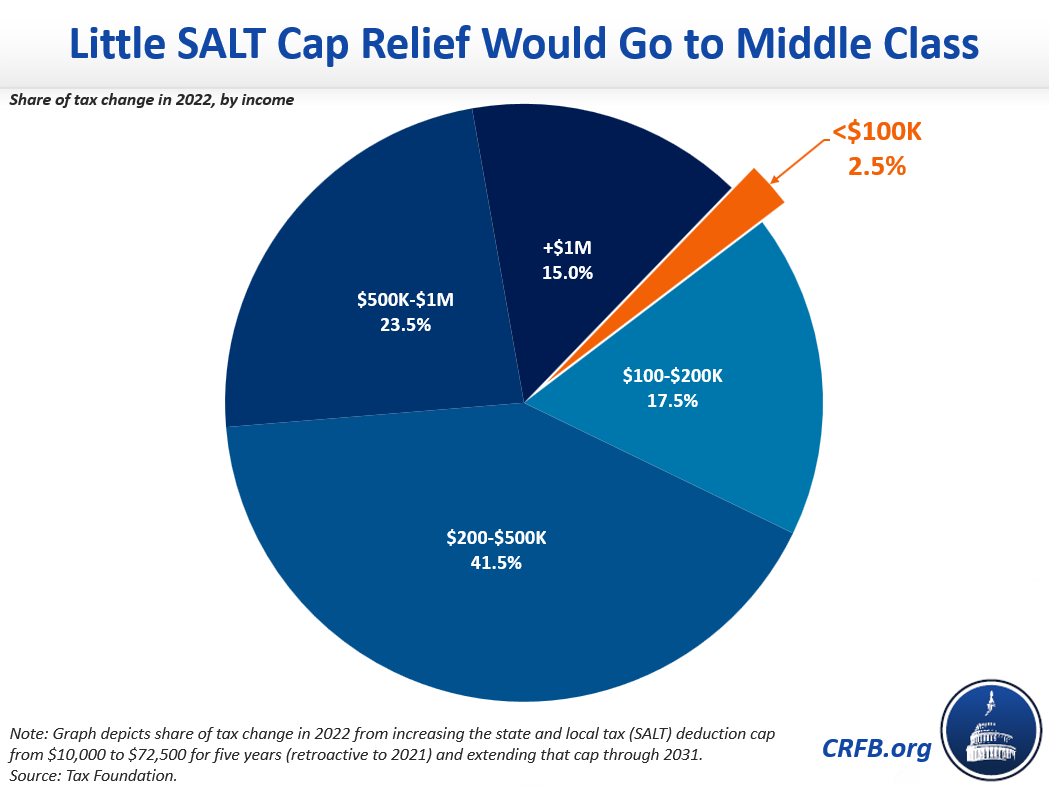

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Ceos Worried About Corporate Tax Hikes As Dems Push Bills Aimed At Boosting Working Families Work Family No Worries Budgeting

Opinion The Bogus Bashing Of Build Back Better Help The Poor Poverty Children Letter To The Editor

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The White House On Twitter White House Staff Frustration White House

Build Back Better May Be Dead But These Key Portions Will Pass Sen Kaine Says

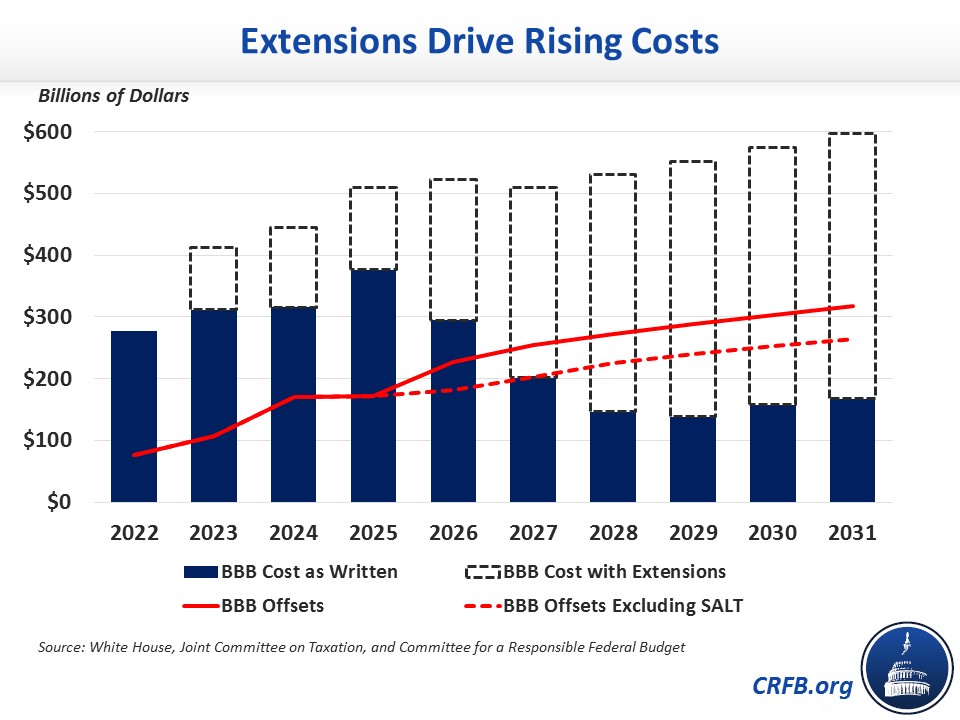

Build Back Better Cost Would Double With Extensions Committee For A Responsible Federal Budget

/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)

Stock Buybacks Why Do Companies Buy Back Shares

With A Smaller Build Back Better Here S What Aid Americans May Expect

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget