aurora co sales tax rate 2021

2021 Colorado State Sales Tax Rates The list below details the localities in Colorado with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. 200 per month on compensation over 250.

There is no applicable county tax.

. Year Municipal Rate Educational Rate Final Tax Rate. 31 rows The state sales tax rate in Colorado is 2900. 4 rows Rate.

Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. Adams County Remainder Cultur. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. For more information regarding sales tax or to apply for a sales tax license please visit the Colorado Department of Revenues website. July to December 2021.

6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. The County sales tax rate is.

The average sales tax rate in Colorado is 6078. Residential Property Tax Rate for Aurora from 2018 to 2021. The Minnesota sales tax rate is currently.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Method to calculate Huerfano County sales tax in 2021. 275 lower than the maximum sales tax in IL.

Wayfair Inc affect Minnesota. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Sales tax rate in Aurora Colorado is 4250.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. For tax rates in other cities see Colorado sales taxes by city and county. The minimum combined 2022 sales tax rate for Aurora Minnesota is.

Fourteen states including Colorado allow local governments to collect an income tax. Depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 3. This document lists the sales and use tax rates for all Colorado cities counties and special districts.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month.

If your business is located in a self-collected jurisdiction you must apply for a sales tax account with that city. You can print a 85 sales tax table here. Real championship 2021 long spine board controversy.

What is a local income tax. Aurora colorado sales tax rate details the minimum combined 2021 sales tax rate for aurora colorado is 8. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

You can print a 825 sales tax table here. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

This is the total of state county and city sales tax rates. Aurora-RTD 290 100 010 025 375. With CD 290 000 010 025 375.

Sales tax change from 3 to 35. A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. None if net taxable sales are greater than 100000000.

Did South Dakota v. Effective January 1 2022 increase of 5 for Measure 2F for the Monument Police Department. Aurora co sales tax rate 2021 Bright Home Investment Blog Uncategorized aurora co sales tax rate 2021 March 20 2021 March 20 2021 By world of cricket.

The Aurora sales tax rate is. With local taxes the total sales tax. Aurora Income Tax Information.

It also contains contact information for all self-collected jurisdictions.

How Colorado Taxes Work Auto Dealers Dealr Tax

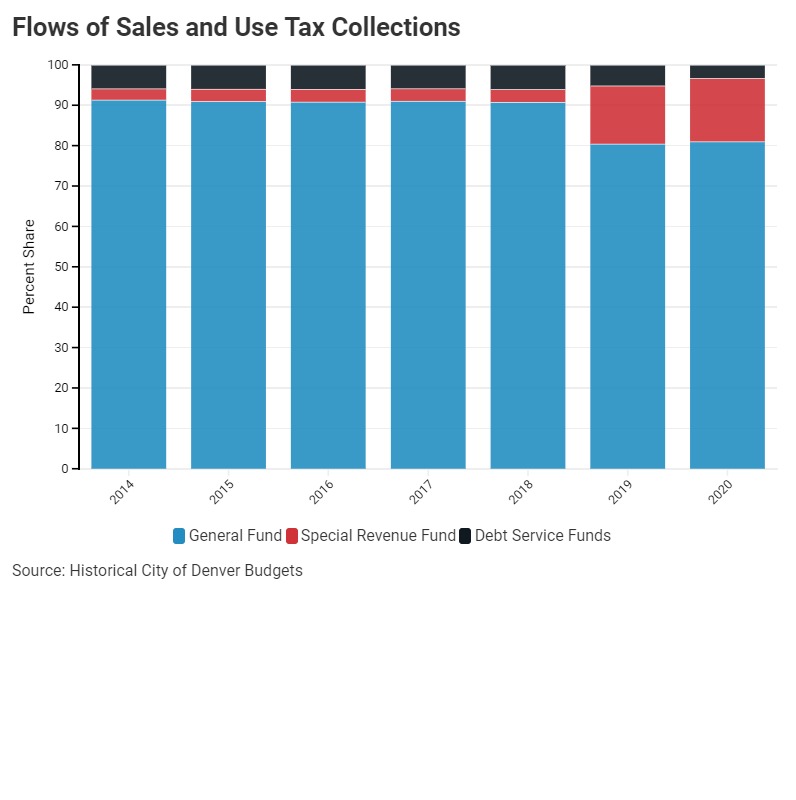

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Rates Douglas County Government

Set Up Automated Sales Tax Center

Property Tax Village Of Carol Stream Il

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

How Colorado Taxes Work Auto Dealers Dealr Tax

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Aurora Colorado Sales Tax Rate Sales Taxes By City

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

European Countries By Hourly Minimum Wage 2017 Vivid Maps European Countries Country Minimum Wage